Agentic AI: The Silent Revolution Transforming U.S. Financial Institutions

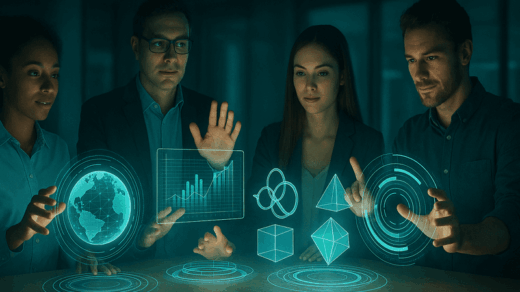

The U.S. financial sector is quietly entering a new era—one not defined by flashy fintech apps or crypto hype, but by Agentic AI. This emerging class of artificial intelligence operates with autonomy, capable of making decisions, initiating processes, and completing tasks without waiting for human prompts.

Unlike traditional AI that assists employees, Agentic AI acts more like a digital workforce, running 24/7 and adapting in real time. And major players aren’t sitting on the sidelines.

Big Banks Go Autonomous

- JPMorgan Chase is experimenting with autonomous AI agents to manage regulatory compliance and document review across thousands of legal agreements—a process that previously consumed countless man-hours.

- Bank of America is testing agentic systems within its customer service operations to proactively identify customer issues, reroute calls, or even resolve certain complaints without live agents.

- Wells Fargo is integrating AI agents to monitor risk in real time, particularly in high-frequency trading and internal audits.

- Goldman Sachs is exploring LLM-powered agents for due diligence and intelligent automation in M&A advisory workflows.

These institutions are turning to platforms like OpenAI’s GPT-powered models, Google’s Gemini, and Anthropic’s Claude to develop agents that not only understand complex language but can also interact with legacy enterprise systems like Salesforce, Oracle, and SAP.

How Agentic AI Works in Financial Workflows

Agentic AI is fundamentally different from rule-based bots or predictive analytics. It perceives goals, maps out multi-step actions, and executes them by interfacing with enterprise APIs and data lakes.

In a U.S. mortgage processing use case, for example:

- The agent extracts data from tax documents,

- Validates income with IRS e-filed returns,

- Flags anomalies using historical approval patterns,

- Notifies underwriters only if human intervention is needed.

This level of cognitive automation was once considered science fiction.

Why U.S. Institutions Are Betting Big

- Cost Efficiency: Banks are under pressure to reduce operating costs while improving customer experience. Agentic AI delivers both.

- Speed & Accuracy: Agents reduce error rates in compliance and documentation-heavy tasks—key in a highly regulated U.S. market.

- Scalability: AI agents don’t sleep, making them ideal for fraud detection, KYC/AML monitoring, and back-office operations across time zones.

But Not Without Risks

Despite its promise, Agentic AI raises serious questions:

- How do you audit a decision made by an AI agent?

- Can agents be manipulated by adversarial inputs?

- What happens when an agent ‘oversteps’ its intended function?

U.S. regulators, including the SEC and OCC, are beginning to scrutinize these systems, urging banks to adopt clear AI governance frameworks. Meanwhile, institutions are forming internal AI ethics boards and hiring Chief AI Officers to oversee deployments.

The Road Ahead

We’re entering a world where your bank might not just use AI—it might be AI. From robo-advisors that automatically adjust your investments to autonomous underwriting of your mortgage, the financial system is quietly being rearchitected by code that thinks and acts on its own.

Agentic AI isn’t just automation—it’s delegation. And for America’s trillion-dollar financial engine, it could be the most powerful shift in decades.