TSMC’s Record Profits Amidst AI Chip Demand: Semiconductor Giant Defies Global Economic Headwinds

Taiwan’s chip manufacturing powerhouse continues its meteoric rise as artificial intelligence applications drive unprecedented demand

Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest contract chipmaker, is experiencing an extraordinary financial surge in 2025, posting record-breaking profits that underscore the transformative impact of artificial intelligence on the semiconductor industry. Despite facing global economic uncertainties and supply chain challenges, the company has emerged as one of the biggest beneficiaries of the AI revolution.

Unprecedented Financial Performance

TSMC’s financial trajectory in 2025 has been nothing short of remarkable. The company reported a stunning 57% jump in net income to NT$374.68 billion ($11.4 billion) for the fourth quarter of 2024, setting a new quarterly record. This exceptional performance continued into 2025, with first-quarter revenue reaching NT$839.254 billion, representing a year-on-year increase of 41.6% that exceeded market expectations.

The semiconductor giant’s full-year 2024 revenue totaled NT$2.9 trillion, marking its highest annual sales since going public in 1994. Industry analysts project that 2025 will deliver even more impressive results, with the company forecasting continued record-breaking performance driven by what executives describe as “insatiable” demand for AI-related semiconductors.

AI Boom Fuels Unprecedented Demand

The artificial intelligence revolution has created an unprecedented appetite for advanced semiconductors, positioning TSMC at the epicenter of this technological transformation. The company’s advanced chip manufacturing capabilities have made it indispensable to major technology companies developing AI applications, from cloud computing giants to autonomous vehicle manufacturers.

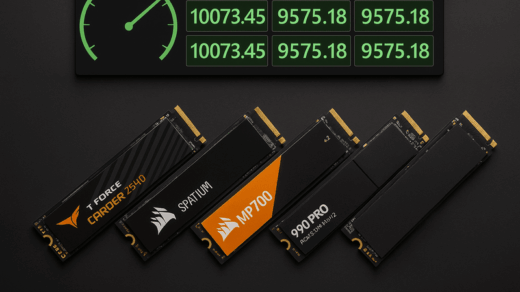

TSMC’s customer roster reads like a who’s who of the technology industry, including Apple, NVIDIA, and other leading firms pushing the boundaries of AI innovation. The demand has been so intense that it has created supply chain ripple effects throughout the semiconductor ecosystem. The company’s massive requirements for CoWoS (Chip-on-Wafer-on-Substrate) chipmaking materials have become so substantial that they’re causing material shortages affecting other sectors, including NAND flash controllers and solid-state drives.

Navigating Global Economic Challenges

TSMC’s success becomes even more impressive when viewed against the backdrop of global economic headwinds. The company has demonstrated remarkable resilience in the face of various challenges, including potential U.S. tariff policies, geopolitical tensions, and supply chain disruptions that have affected many other technology companies.

The semiconductor industry has been particularly sensitive to trade policy uncertainties, especially regarding U.S.-China relations and export controls on chip technology. However, TSMC has managed to navigate these complexities while maintaining its growth trajectory. The company’s leadership has actively engaged with policymakers, including meetings between CEO C.C. Wei and senior U.S. officials to address potential trade concerns.

Market Dominance and Future Outlook

TSMC’s technological leadership in advanced chip manufacturing has created a virtual monopoly in the production of cutting-edge semiconductors essential for AI applications. The company’s mastery of the most advanced manufacturing processes, including 3-nanometer and 5-nanometer technologies, has made it virtually irreplaceable for companies developing next-generation AI hardware.

Industry experts predict that TSMC’s dominance will continue to strengthen throughout 2025 and beyond. The company’s executives forecast that AI servers will account for more than 20% of revenue by 2028, compared to a low-teens percentage in 2024. This projection suggests that the current AI boom is not merely a temporary surge but represents a fundamental shift in semiconductor demand patterns.

Supply Chain Challenges and Strategic Responses

Despite its financial success, TSMC faces significant operational challenges. CEO C.C. Wei has acknowledged that supply chain constraints will likely persist, predicting that the balance between AI chip supply and demand won’t be achieved until 2025 or 2026. This shortage dynamic has actually benefited TSMC’s pricing power, allowing the company to command premium rates for its advanced manufacturing services.

The company has responded to these challenges by aggressively expanding its production capacity and investing in next-generation manufacturing technologies. These strategic investments position TSMC to capture an even larger share of the growing AI chip market while maintaining its technological edge over competitors.

Industry Impact and Broader Implications

TSMC’s record performance reflects broader trends in the technology industry, where artificial intelligence has become the primary driver of innovation and investment. The company’s success has had cascading effects throughout the semiconductor supply chain, benefiting equipment manufacturers, materials suppliers, and other companies in the ecosystem.

The financial windfall has also strengthened Taiwan’s position as a critical hub in the global technology supply chain, though this prominence has also increased geopolitical attention on the island’s semiconductor industry. TSMC’s continued success will likely play a significant role in shaping international technology policy and trade relationships.

Looking Ahead

As TSMC continues to break financial records in 2025, the company faces the challenge of sustaining this extraordinary growth trajectory. While AI demand shows no signs of slowing, the company must navigate increasing geopolitical complexities, manage supply chain constraints, and continue investing in next-generation technologies to maintain its competitive advantage.

The semiconductor giant’s remarkable performance amidst global economic uncertainty demonstrates the transformative power of artificial intelligence and positions TSMC as one of the most important companies in the ongoing technological revolution. For investors and industry observers, TSMC’s continued success serves as a barometer for the health and trajectory of the broader AI economy.